Market Update May 2023

In this edition of The Smith Report, we will be talking about 3 things to help you navigate the marketplace:

- Price update.

- Inventory & foreclosures.

- Upcoming recession?

As always, it is a pleasure to serve you and your family. We take our job seriously in doing our best to bring value to your real estate journey. I want to remind everyone that there is no good news or bad news. News is just news, in a similar fashion where facts are facts. Anything after that is a matter of perception and a state of mind.

Price Update

This quote by Doug Duncan, SVP & Chief Economist of Fannie Mae has brought up a great question amongst our great clients:

Have Home Values Stabilized?

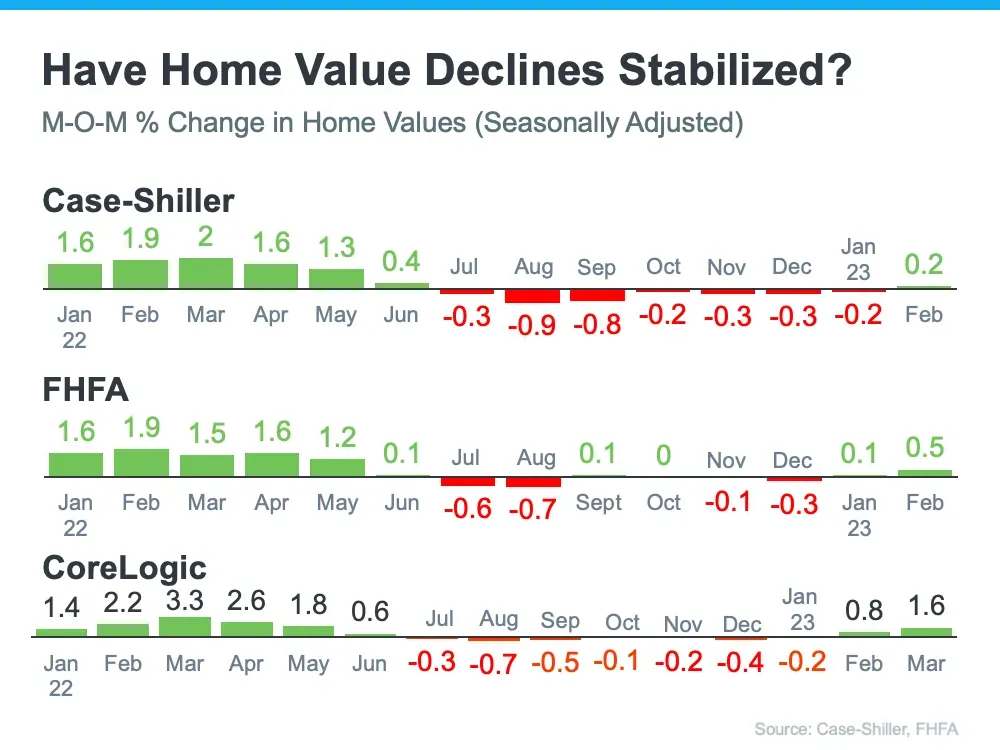

Over the last couple of months, we have been updating our readers with month-over-month price changes to keep on the pulse of home value declines. As we all experienced and already know, prices dropped during the summer. Nothing to match the wild news headline numbers of percent in value lost. The most significant drop we saw in home values is just under 1% in August 2022.

As you can see in the chart below, since January 2022 home values began to cool off from FREE COVID EQUITY and taper off by the middle of the year through summer 2022. Much of this was due to rising interest rates and all the factors we mentioned in our previous monthly market updates. As we receive the latest information, we start to see the turn in the market and begin to notice the worst in price declines are behind us and clearly home prices are not spiraling downward heading to a crash in a free-fall the way news media promotes. We stick to the facts.

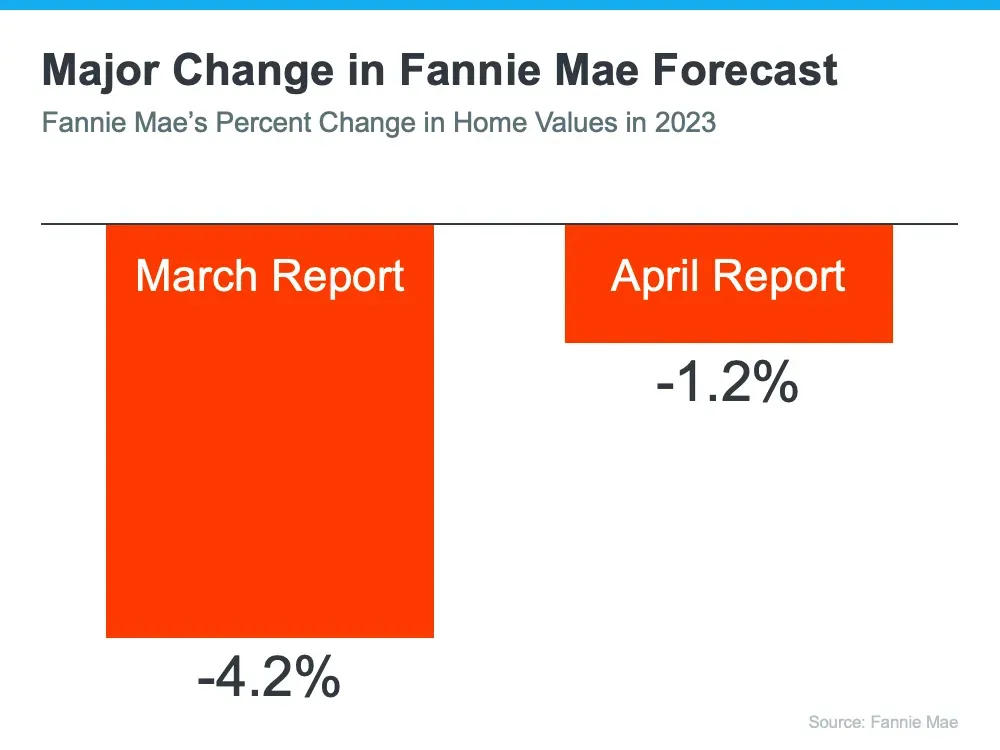

Black Knight’s research results are welcome news for homeowners that were wondering what has been happening with home prices. This news is a good compass for home value forecasts, and we will soon begin to see multiple forecast revisions.

Inventory & Foreclosure Update

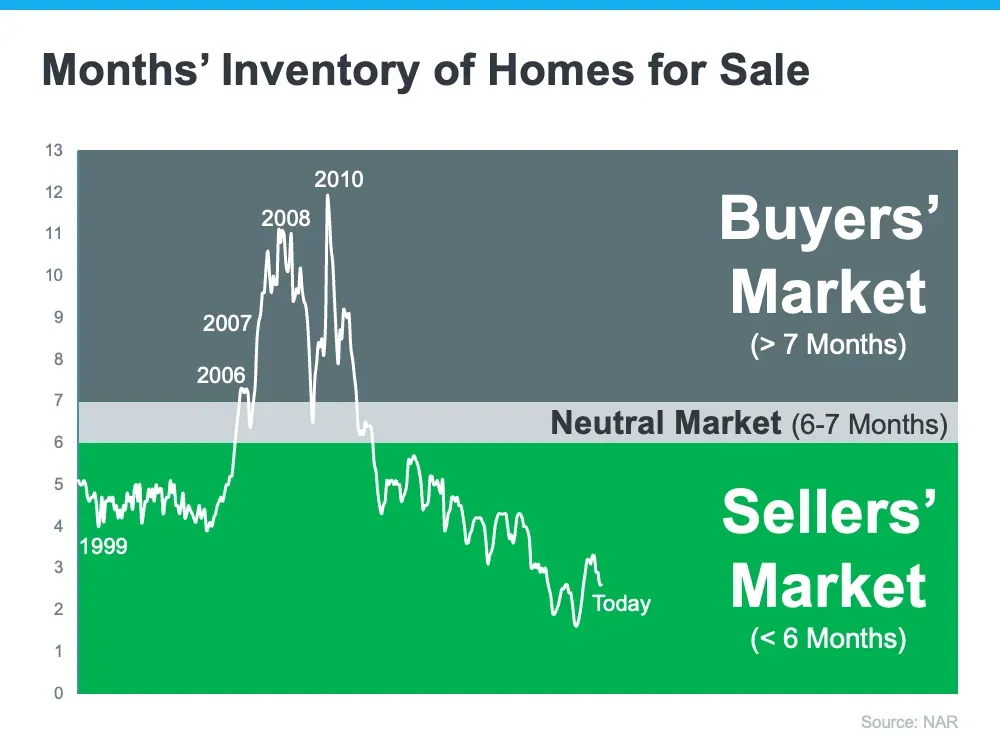

One of the reasons we are seeing prices go up is the lack of inventory. A normal healthy market has between 6-7 months of inventory for sale. It becomes a buyers’ market when there is a surplus of inventory available, more than 7 months of inventory. It becomes a sellers’ market when there is a lack of inventory for sale, in less than 6 months. Let’s take a look at where we are at today and get an overview since the late 90s to put some context to the content of another market crash similar to 2008.

As you can see leading up to, and during, the 2008 crisis inventory rose. For the last several years we have been in a sellers’ market and continue to be in a seller’s market today. Right now it is not possible for prices to drop more. Let me tell you what the news isn’t telling you.

Did you know that according to the National Association of Realtors (NAR), the average housing inventory for a healthy market is 1.5M homes on the market?

Did you know that in order for prices to drop we have to have an inventory north of 1.5M?

And did you know… that according to the real estate experts, right now we are at an inventory of 600K which is only 300K more than last year?

Did you know that?

We need more inventory and it is continuing to be a strong sellers’ market WITH strong buyer demand. Homes that are priced right sell quickly and with the right marketing, sell above the list price. Who you work with matters.

We here at Your Home Sold Guaranteed Realty Premier have a track record of selling homes at 103% of the asking price or we will pay you the difference in cash. If you are planning to sell in the next 3-6 months we are more than happy to provide you with a complimentary market evaluation to determine what your home would sell for. Also, we can give you tips on what to do and what not to do to sell your home for the most amount of money, and we can go over all the various closing costs you will incur so you will know exactly what you will have left in your pocket after all expenses. It’s FREE of charge and obligates you to nothing.

Give us a call at (714) 406-1414 to schedule your complimentary market evaluation for your home.

If you are planning to buy in the next 3-6 months we are more than happy to get together and create a step-by-step plan to give you the smoothest home-buying journey you will experience. We will provide you with exclusive access to off-market properties such as foreclosure, pre-foreclosure, for-sale-by-owner, and our exclusive RBID homes, and other distressed sales that you won’t find online like Zillow, Trulia, or Realtor.com. It’s a free service and you’re never obligated to buy a home.

We are more than happy to provide you with a tour of homes available both on and off the market. What’s the worst that could happen?

- You get your credit run once.

- You spend a couple of days looking at houses with a Realtor to see what’s available for you.

Has there ever been a time when a store offered you a credit on the sale, just to run your credit… and you ran your credit for a discount on a couch at Ashley’s Furniture!

What’s the best that could happen?

- Homeownership.

- Appreciation… EQUITY… home prices are appreciating for the next few years.

We have been hearing a similar comment amongst our clients: “What about the information in the news that inventory is going to rise with a flood of foreclosures for sale?â€

While these headlines may be factually correct, it’s not the full story. Headlines like these can do a lot to mislead people. Again, they are factually correct, yet very misleading. Here is the reality of Foreclosures and whether or not we are on the same or similar path to a housing bubble, market crash, or doomsday economy.

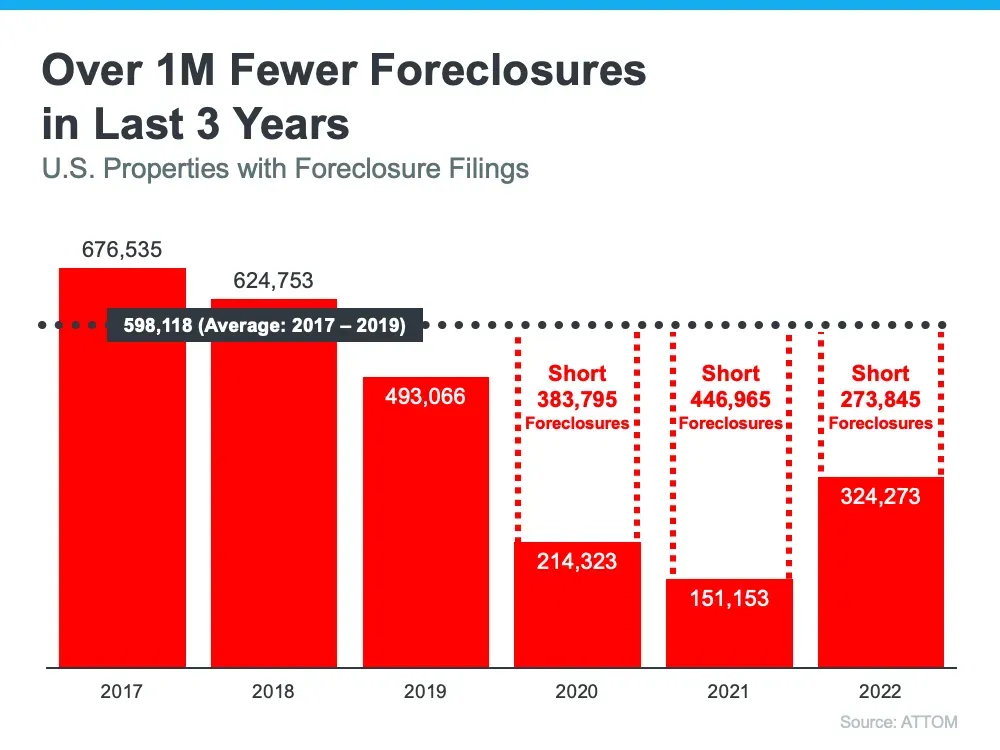

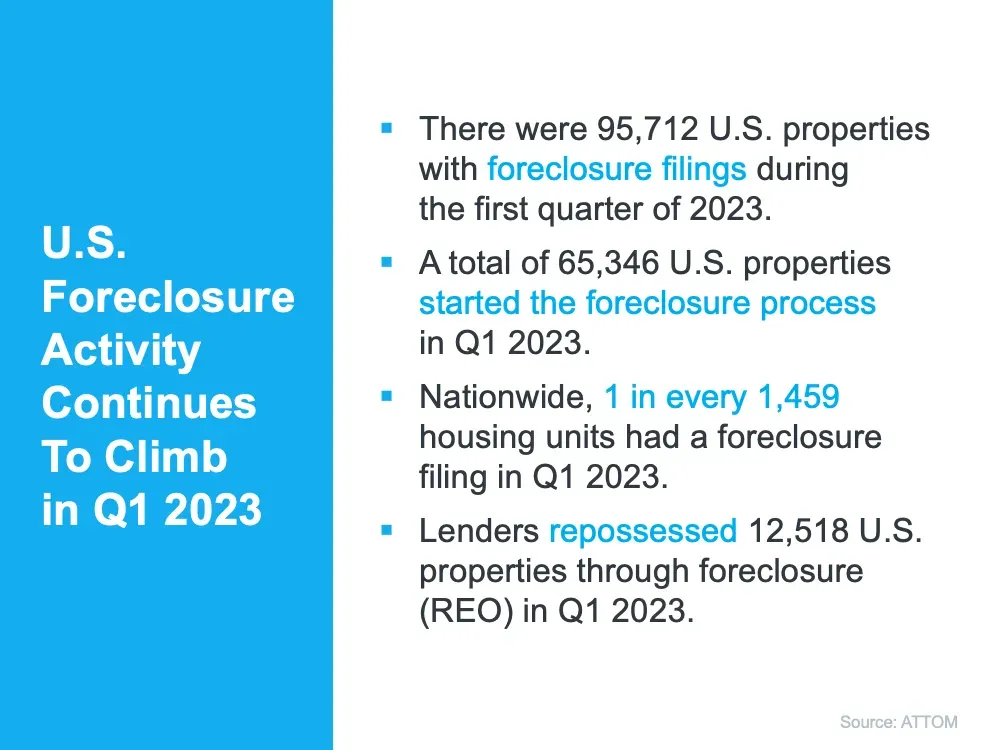

There are over 1 million fewer foreclosures in the last 3 years than the average amount of foreclosures heading into 2020. The moratorium during COVID, where you literally can’t foreclose on people, aided a lot of homeowners. Now that we have come out of COVID and the moratorium we should expect foreclosures to rise but not at a dramatic rate where inventory will shoot up and put us into a buyers’ market. Again, the people who write news headlines and stories are in the News Media Industry, not the Real Estate Industry. Whoever wrote the headlines obviously didn’t see this foreclosure information:

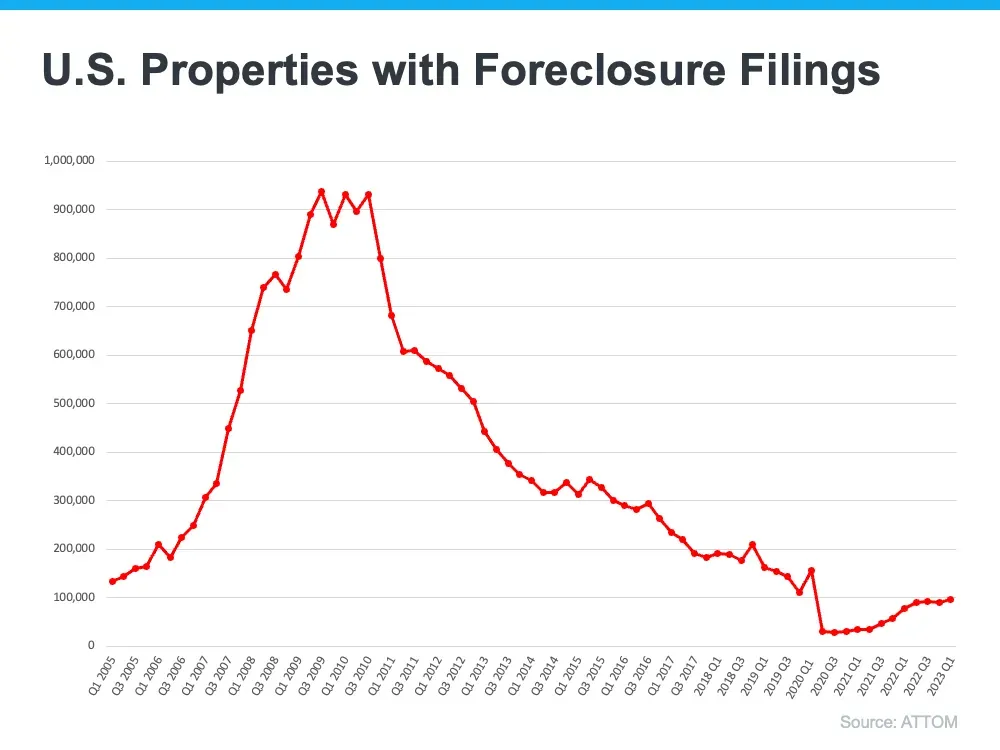

This graph shows foreclosure filings all the way back to 2005. You will notice that foreclosures began to spike leading to the 2008 crash. Today we are a little bit higher in foreclosure filings than the last 3 years and still below the foreclosure filings of 2005.

Headlines do more to terrify than they do to clarify what is actually going on. This is nothing near to what the news headlines lead us to believe. Here is what is happening with foreclosures in 2023 so far:

Is There an Upcoming Recession?

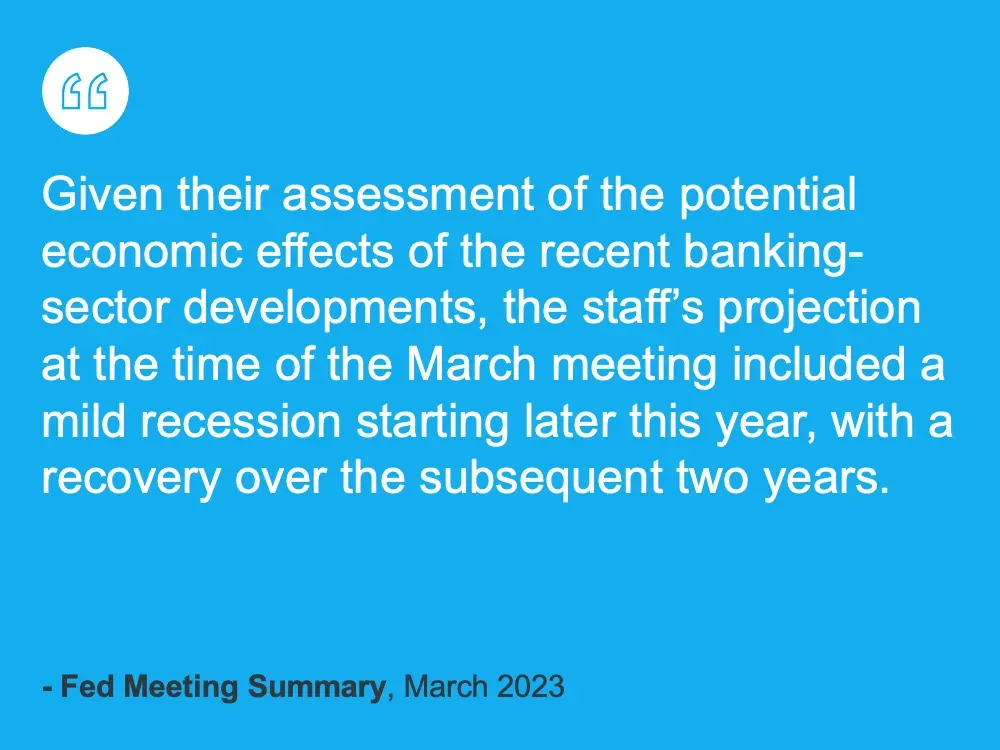

The FED’s met and raised the FED fund rates which caused a lot more questions about a recession. The FED recently stated in April:

With that being said you will begin to hear a lot of talk of recession and these talks will heat up. So let’s look at what the FED is actually saying.

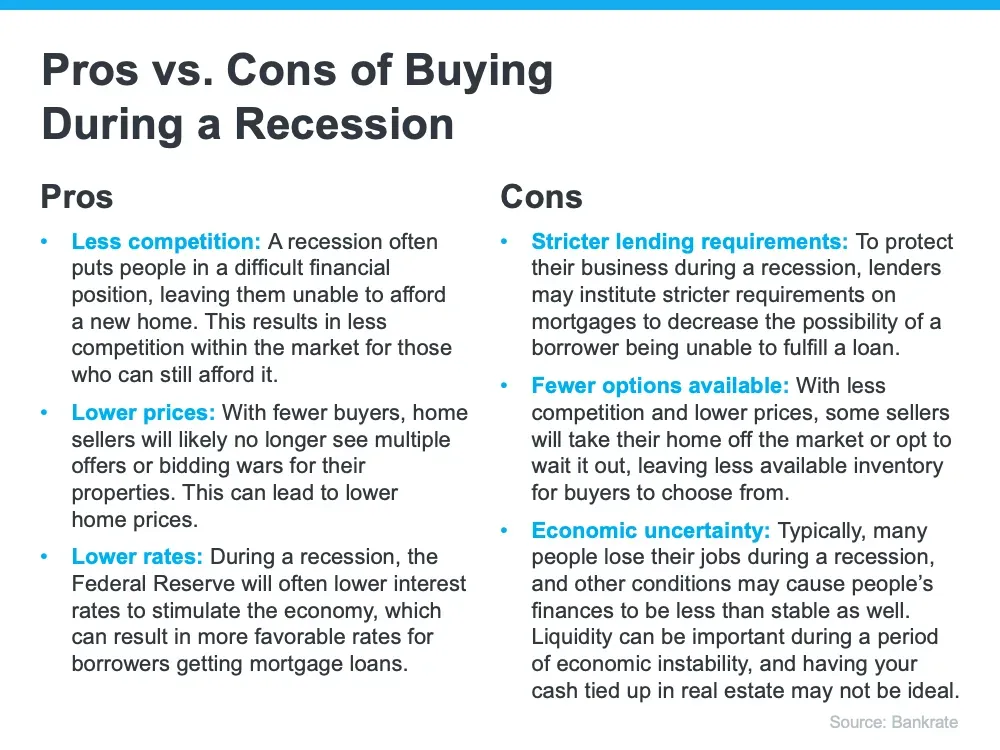

There are 2 things our great clients ask us:

- What defines an economic recession?

- How would housing be affected?

There have been lots of debates and talks regarding the term “recession†and how it is defined. Here is what we do know based on the facts:

Yes, we have had 2 months of negative GDP many times. So how will housing be affected?

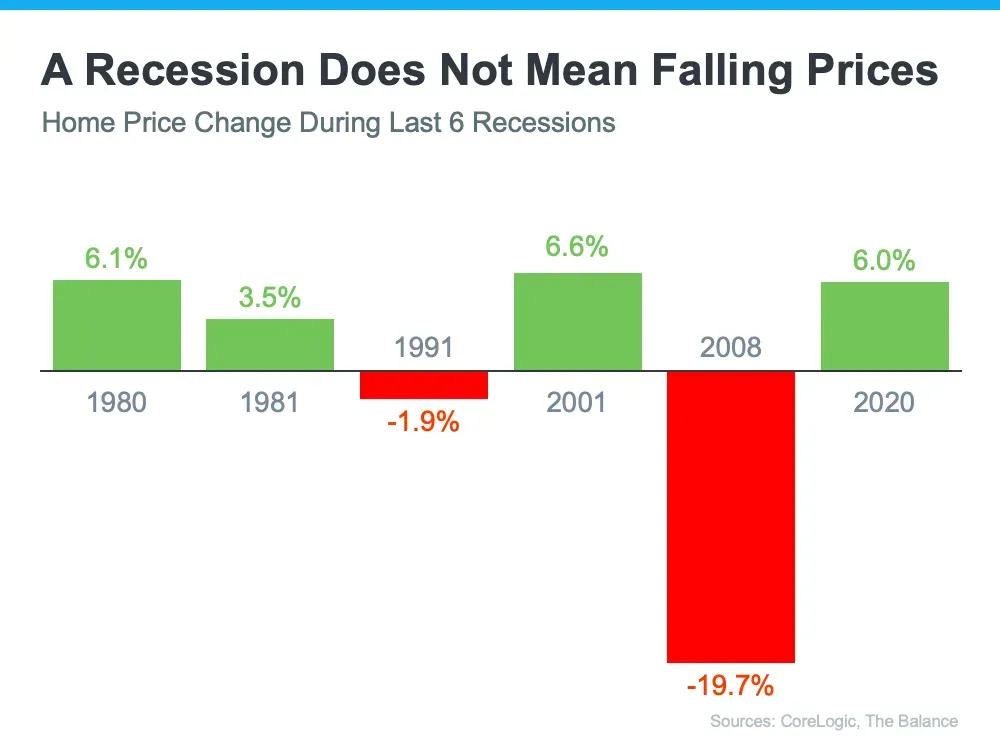

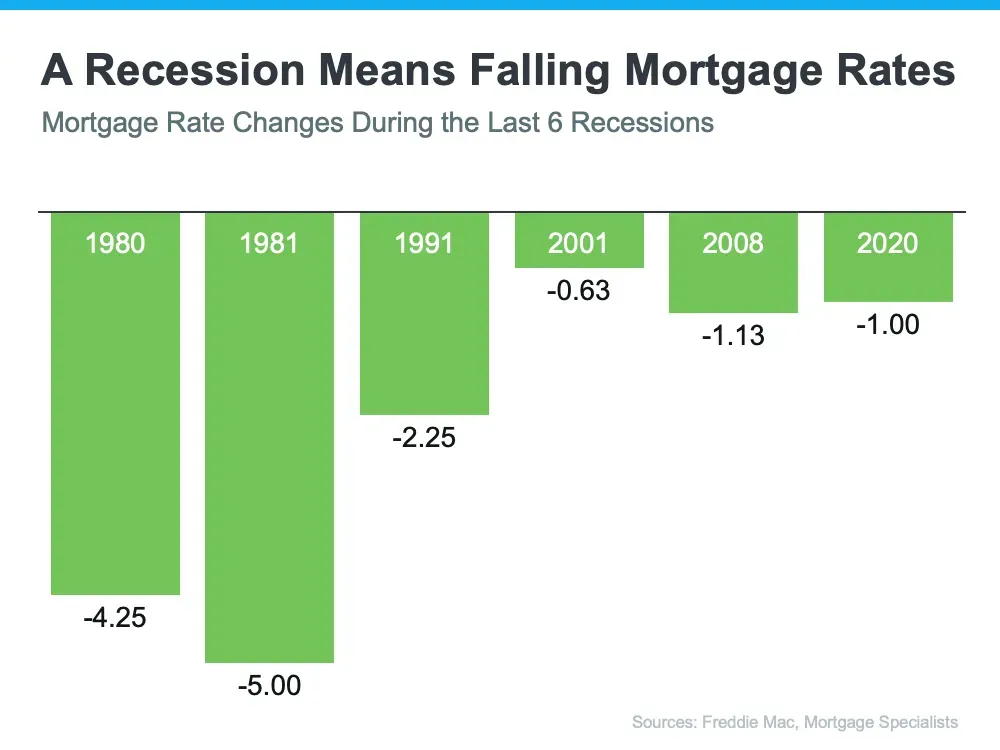

In 4 out of 6 recessions, prices rose, and 2008 arguably was not a “natural†recession. So it’s more like 4 out of 5 recessions prices rose. Either way, the recession is healthy for the housing market; prices rise and rates drop. What everybody associates recession with is the housing crisis of 2008. A lot of people were hurt and properties lost value. So when people hear recession, especially millennials, they think of the 2008 crash.

We are in one of the strongest foundational real estate housing markets of our lifetime. Again, it’s not possible for the market to crash for 2 reasons in addition to inventory, demand, and price.

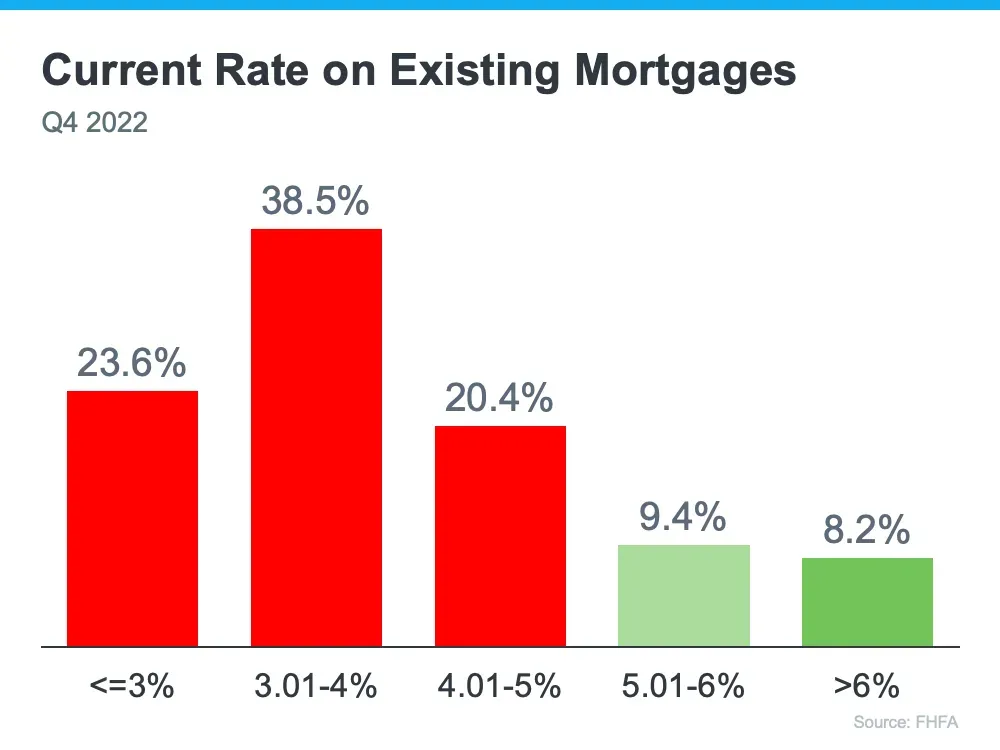

- The current rates on existing mortgages, according to FHFA, as of the 4th quarter of 2022. Over 80% of existing mortgages are below 5%; Over 50% of existing mortgages are below 4%. These homeowners, they will work as hard as they can to keep that mortgage. Here’s why, you can’t rent in today’s market for as low as their mortgage payment is.

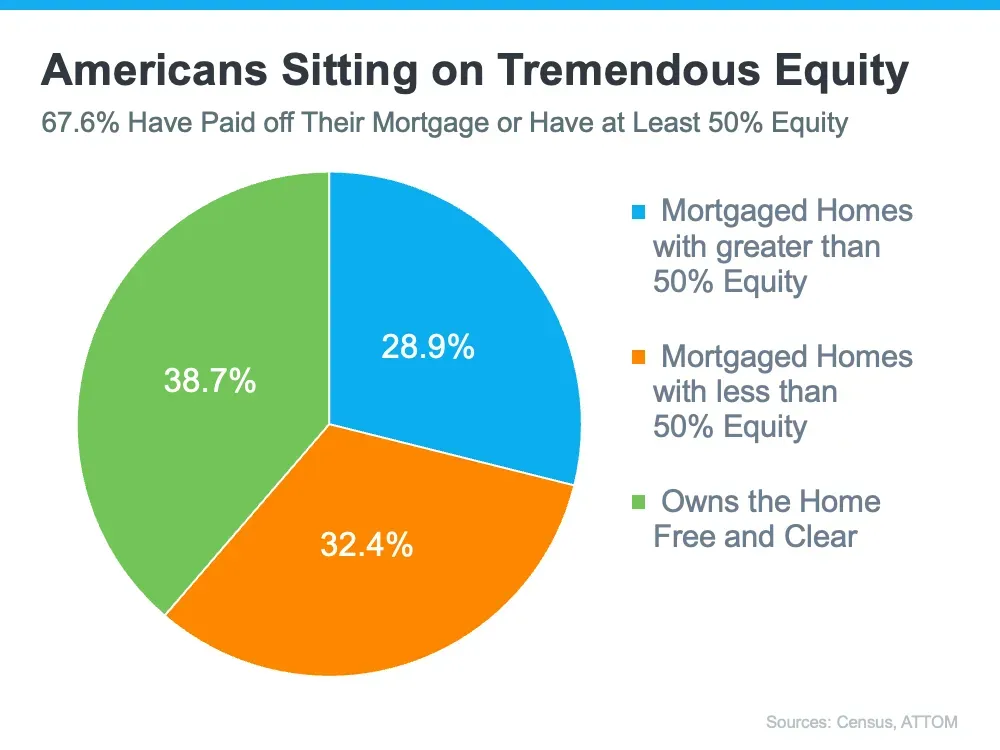

- Americans are sitting on tremendous equity. Almost 68% of homeowners have either paid off their mortgage or at least have 50% equity. 38.7 % of homeowners own their homes free and clear. 28.9% are equity rich, meaning they have at least 50% equity.

Back in 2008, people walked away from their homes because they literally owed more on the home than it was worth. Today, the lessons learned in protecting the equity in our homes are reflected in our equity-rich residential real estate foundation.

So remember, when articles and news media come up with “FORECLOSURES ARE ON THE RISE!†“MARKET CRASH,†“DOOMSDAY!!!†let’s compare to the facts of the entire story. We currently live in a very very strong housing market.

THE CALIFORNIA DREAM FOR ALL PROGRAM IS GONE! DID YOU MISS IT…?

Who you work with matters, and we have been assisting our clients create a step-by-step plan to successfully navigate their qualification process and then find our clients a good deal with off-market properties. We are a full-service real estate firm. We work only with the best in the industry as a reflection of our clients and who we are as a brand. We have the best lender in the area. A lot of our clients benefited a lot from the California Dream For All program; it worked very very effectively. For those of you that missed out or were not first-time home buyers for the California Dream For All Program, be sure to take advantage of this opportunity. Our in-house partner lender has a rare program and opportunity to have last year's rates in today’s market. Our clients have been getting between 4%-5% which drastically increased their purchasing power and area they can buy in.

If you are upgrading your home, downsizing, or you missed out on California Dream For All as a first-time home buyer and you are looking for a good deal call now to set up a time so we can help you create a step-by-step plan for your home buying journey. With us, real estate is not a transaction but a journey. And with us, you are not buying a house but a lifestyle. We will also give you exclusive access to off-market properties such as foreclosure, pre-foreclosure, for-sale-by-owner, and our exclusive RBID Homes and other distressed sales that are not available online and you won’t find on Zillow, Trulia, or Realtor.com. It’s a free service and, of course, you’re never obligated to buy a home.

If you need to sell in order to buy or are just considering liquidating to have some disposable cash in hand we have 2 very unique programs available for you. For those of you who would like the convenience of the sale without all the hassle of showings, marketing, and preparing the home we have a Cash Offer program. We have been succeeding with our Cash Offer program in getting very close to fair market value on a CASH OFFER within 48 hours. We also have a Guaranteed Sale Program if you are looking to extract the most value from your home with the least amount of cost to you. We are happy to give you a FREE Market Evaluation to determine what your home would sell for. Also, we can give you tips on what to do and what not to do to sell your home for the most amount of money, and we can go over all the various closing costs you will incur so you will know exactly what you will have left in your pocket after all expenses. It’s FREE of charge and obligates you to nothing.

We’ve been hearing a lot of the same feedback that people are waiting for prices to drop AND rates to drop. Not only are you thinking that, but so is everyone else. And if you are waiting for that and you are not already in escrow about to close… you’re missing the opportunity you’ve been waiting for. Here is why:

- Prices and interest rates have an inverse relationship. When prices go up, rates drop. When prices drop, rates go up.

- Both prices and rates only drop together in the midst of an anomaly of a current event such as COVID-19 and Banks closing.

- By the time you hear it in the news, it’s already over and gone. Here’s why, we can only provide data verifying the lowest prices and lowest interest rates during a period of time after the fact. In other words, we only have collected verifiable data after the deals have closed and recorded, and we have new higher prices or rates to compare it to. The information comes in arrears, not in advance.

- Real Estate in America has been going up non-stop for the last 50 years… so we wonder… What are people waiting for… to buy at a more expensive price ??

If you wait for prices and you wait for rates to be low to find a good deal, and everybody else who is waiting just like you hears about it in the news after the fact… guess what you have? Walmart on Black Friday and inventory is absorbed fast, multiple offers, above list price negotiations.

Here is a great story of a great client who decided to stick to the data and trust the process. Just before COVID, our great client was a first-time home buyer back when homes in Anaheim were still $700K on average. The payment was a little bit of a stretch yet all the data points were showing that real estate properties were going to continue to go up. Our client took all the data he had and asked himself… what am I waiting for… he took the leap of faith despite the payment being a little bit of a stretch. Today our great client recalls that memento and keeps reminding us to send him data and information, here's why: Since then his property appreciated to over $1M and he had enough equity to buy more rental properties and collect rent, creating multiple streams of income for himself. He is very very happy about that decision and the only regret he would have had is that he didn’t make the jump and he wouldn’t have had any idea of the type of lifestyle that was waiting for him a few years down the road because of this one purchase that was a little bit of a stretch.

With all the data we have shared it is important to stick to the facts. Media sells, fear sells, and negativity sells. Always keep in mind what the whole story is. All too often we make decisions on content without the full context. We would like to close this edition of The Smith Report by wishing you all continued success in all your endeavors this 2023!

Don’t be easily swayed or fooled by the headlines of the news. Fake news headlines are made to sell news by people who don’t understand or work in the Real Estate Market. Remember that those are news stories, fake news, and that negativity sells not the heroic events of our military, law enforcement, paramedics, firefighters, doctors, and nurses.

Seek the reality of the situation.

As always, we are not here to hustle you, we are not here to sell you… We are here to inform you, we are here to serve you, and we are here to help.

We are more than happy to provide you with exclusive access to off-market properties such as foreclosure, pre-foreclosure, for-sale-by-owner, and our exclusive RBID Homes and other distressed sales that you won’t find on Zillow, Trulia, or Realtor.com.

We are more than happy to provide you with a free market evaluation to determine what your home would sell for. Also, we can give you tips on what to do and what not to do to sell your home for the most amount of money, and we can go over all the various closing costs you will incur so you will know exactly what you’ll have left in your pocket after all expenses.

If you are looking to buy now or sell now, we are always available to provide the most accurate market evaluation and create the most detailed step-by-step plan for your successful home-buying journey.

Feel free to give us a call at (714) 406-1414.