Market Update February 2023

In this edition of The Smith Report, we will be talking about 3 things to help you navigate the marketplace

- Interest Rates (there has been a lot of movement)

- Inventory (it has been a significant issue in real estate recently

- Misleading Headlines

As always, it is a pleasure to be able to serve you and your family. We take our job seriously in doing our best to bring value to your real estate journey. I would like to remind everyone that there is no good news, and there is no bad news. News is just news, in a similar fashion where facts are facts. Anything after that is a matter of perception and a state of mind.

Interest Rates

There has been a lot of movement happening in the marketplace. The type of movement that takes 6-7 months is happening in as little as 72 hours and as your real estate professional, we must break these movements down for you to best serve you so you can navigate the marketplace.

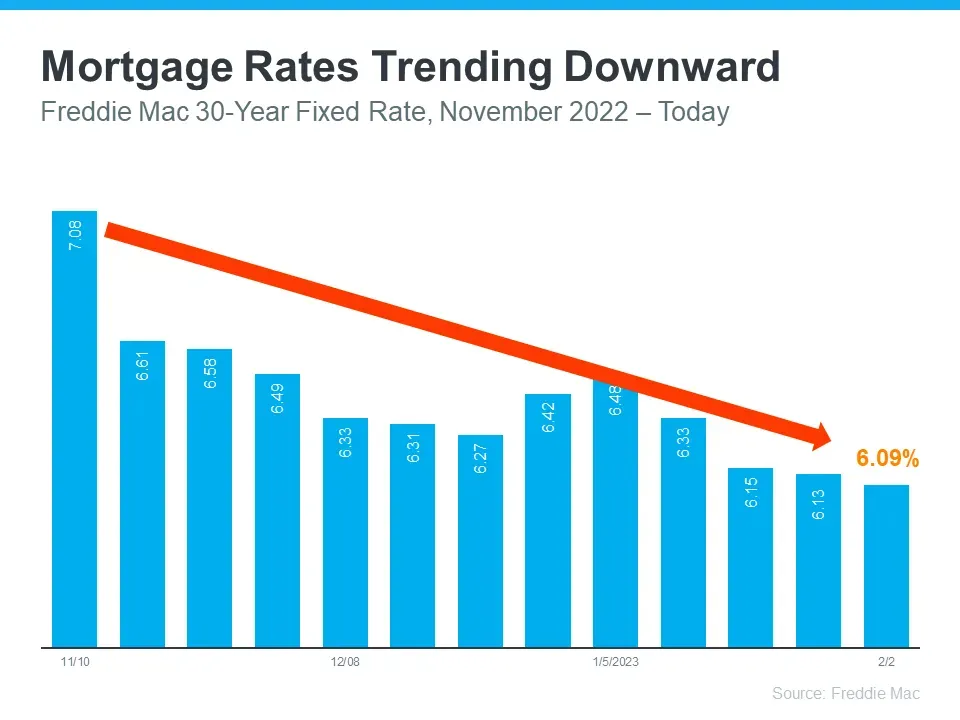

We can confidently say that mortgage rates are trending downwards, a lot of our clients that took advantage of the new updated ARM loans with stricter regulations are continuing to reap the benefits of the dropping rates. The average mortgage rate peaked in the first half of November and we have been in an overall downward trend since then. From mid-November to Feb 2nd we are just shy of a full percentage point drop as you can see below.

Over the last few years as rates started to skyrocket a lot of homebuyers put their journey on pause. As we shared in our past monthly updates, the lowest historic rate before the crash was 12.88% in the late 80s. So it wasn’t necessarily the rates that shocked consumers but how fast they rose, along with the rapid rise in prices.

Now in February 2023, the market is showing that consumers are starting to understand this. They are becoming adjusted to the new norm. As we see relief in rates we notice more demand coming back into the marketplace. We’ve noticed when a house is priced right in the market it sells quickly. And with our marketing strategy, we've continued to get top dollar for our sellers at an average of 103% of the asking price. We’ve even started to see multiple offer scenarios… but not like the COVID Market multiple offer scenarios. Those days are a thing of the past. If you would like a free market evaluation to determine what your home would sell for we would be more than happy to provide you with one. Also, we can give you tips on what to do and what not to do to sell your home for the most amount of money, and we can go over all the various closing costs you will incur so you know exactly what you’ll have left in your pocket after all expenses. Let’s set up a time to create your step-by-step plan to get you top dollar for your home. Call now.

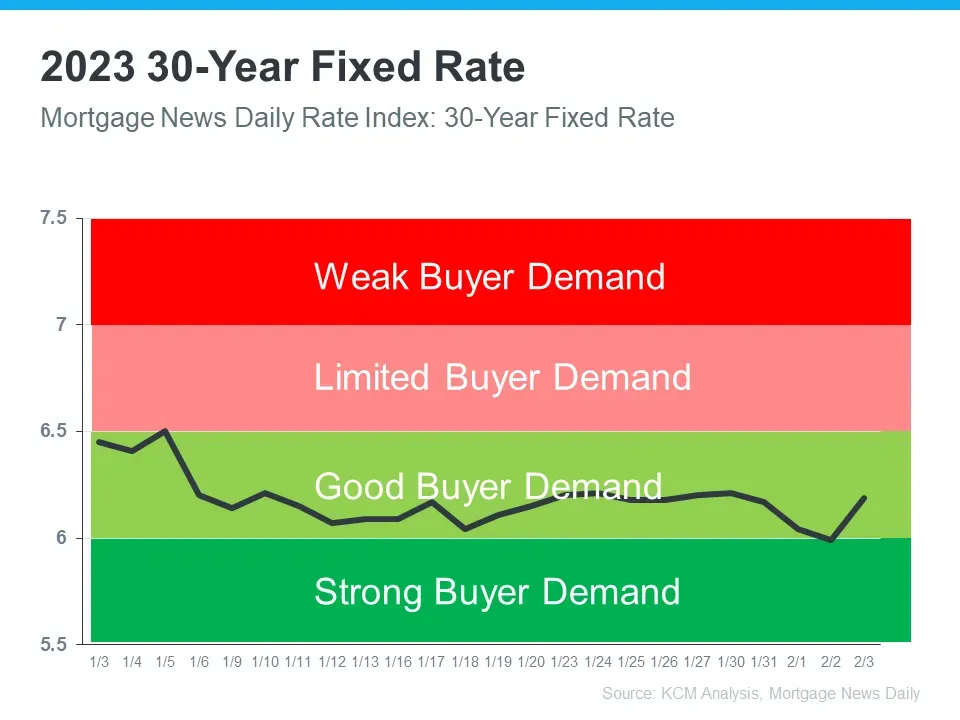

As we observe the rates impacting the market here is what we have noticed between 6.5-7%. We saw limited to weak buyer demand. Once we broke the threshold of 6.5% we saw an influx of buyers giving us good to strong buyer demand. Entering 2023 to today we have been seeing good buyer demand.

Inventory

We are heading back into a period between good and strong buyer demand based on where rates are trending. Right now we have an average of 127 buyers looking for a home in multiple cities in Orange County, Riverside County, and Los Angeles County. If you are considering selling we would love it if you can show us your home and see if it’s a good fit for one of our buyers. Let’s set that up in the link in this email.

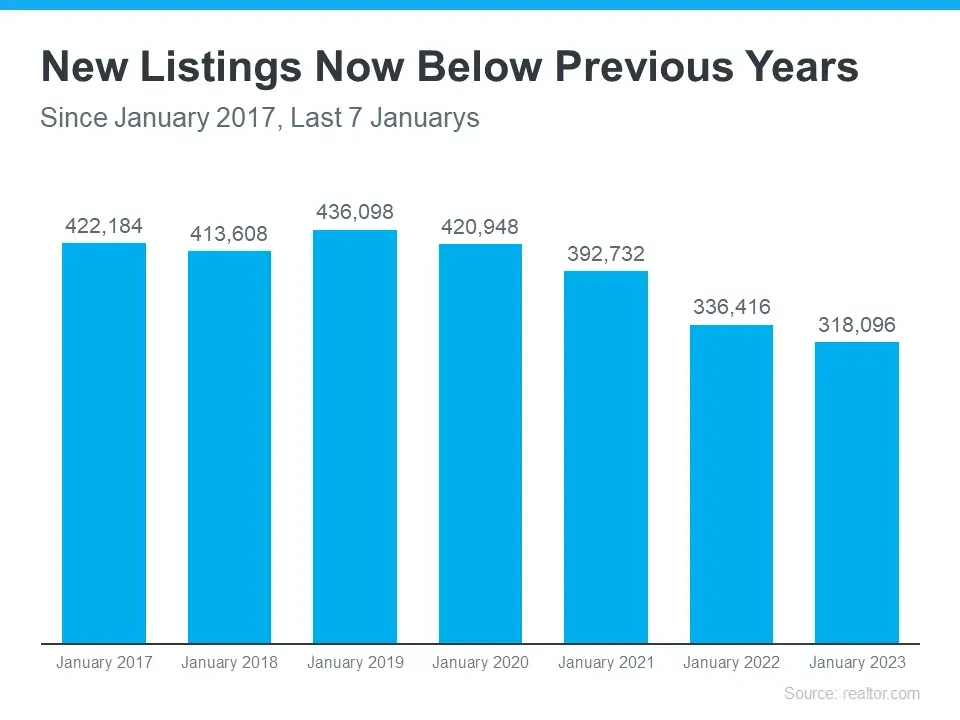

The only issue we are running into going into the spring market is that now houses are below previous years. Right now prices can't drop more. Let me tell you what the news isn’t telling you. Did you know… that according to NAR the average housing inventory for a healthy market is 1.5M homes on the market…?? Did you know that? And did you know that for prices to drop we have to have an inventory north of 1.5M…?

And did you know that according to the real estate experts, right now we are at an inventory of 600K which is only 300K more than last year?

If you are on the fence about buying right now ask yourself these 2 questions:

- What’s the worst that could happen?

- You get your credit run once…

- You spend a couple of days looking at houses with a Realtor to see what’s available for you.

Has there ever been a time when a store offered you a credit on the sale, just to run your credit!!! And you ran your credit for a discount on a couch at Ashleys’ Furniture…!

- What’s the best that could happen?

- Homeownership; You become a homeowner

- Appreciation… You begin to develop and establish long-term wealth. Home prices are appreciating 10% this year, year-over-year.

Let’s break down why consumers think a market crash is to be expected. A lot of our clients feel a market crash is near, we felt the same way and what we found based on the data is the exact opposite.

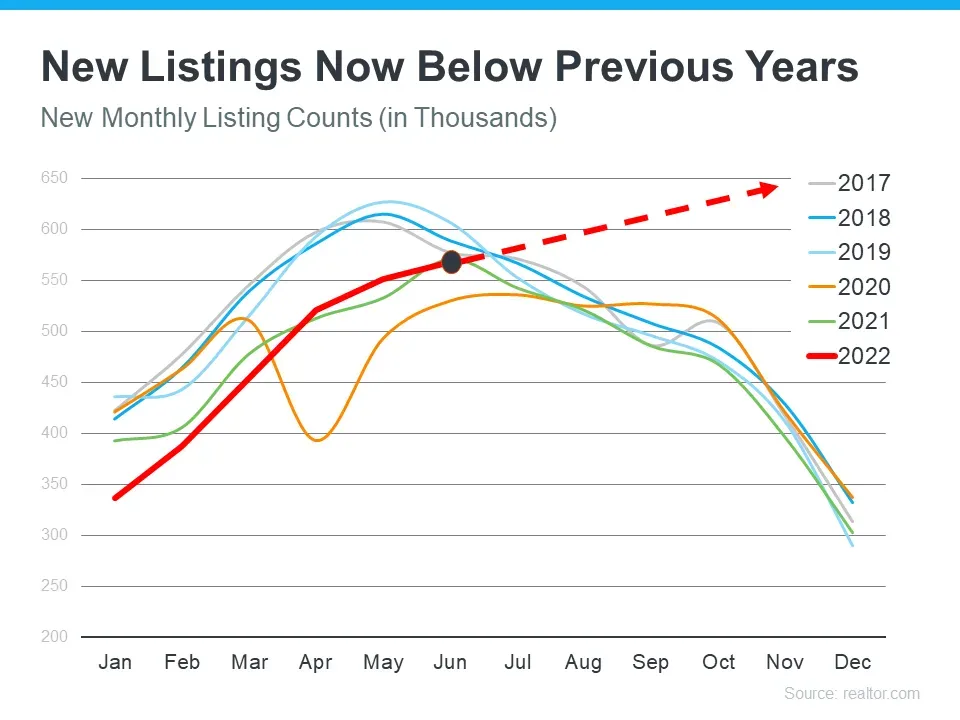

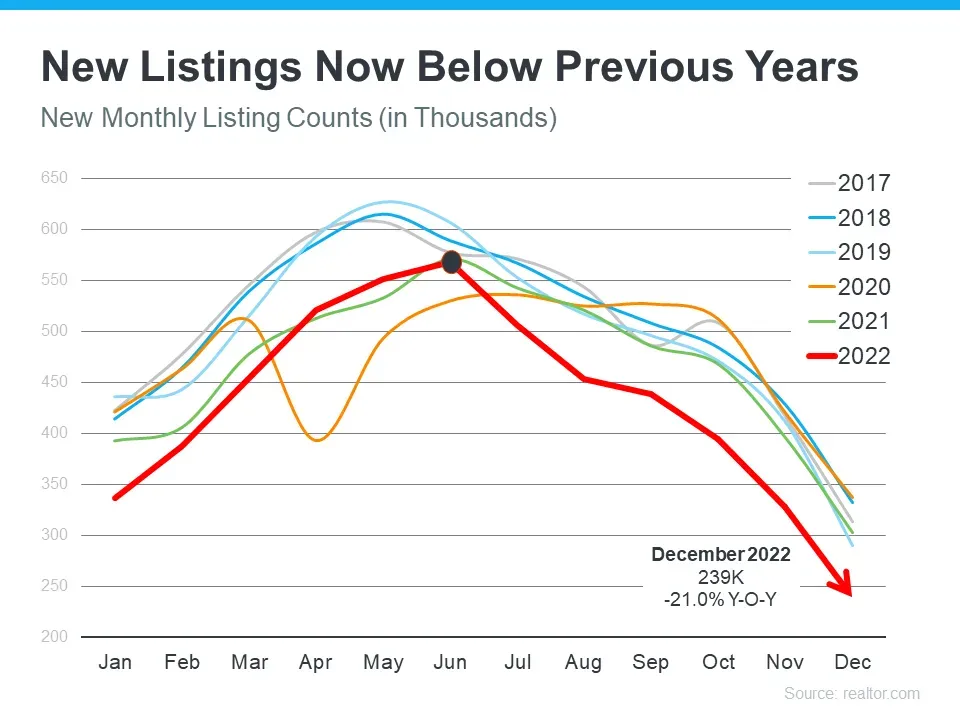

The red line in the chart above represents new houses coming onto the market for the year 2022. The case that consumers were making is that houses would continue to enter the market in an upward trend with no buyer demand to support it. The narrative was that as houses climbed and fewer and fewer people wanted to buy, the market would crash. This is the theoretical case people would make as to why the market was imminent to crash. In actuality here is what happened. New houses started to fall, we brought new houses into the market at a drastically slower rate due to uncertainty and consumers having a lack of facts compared to the narrative of the news media. This fact of not enough houses is what kept the upward pressure on prices. December 2022 ended with 21% fewer houses coming into the marketplace.

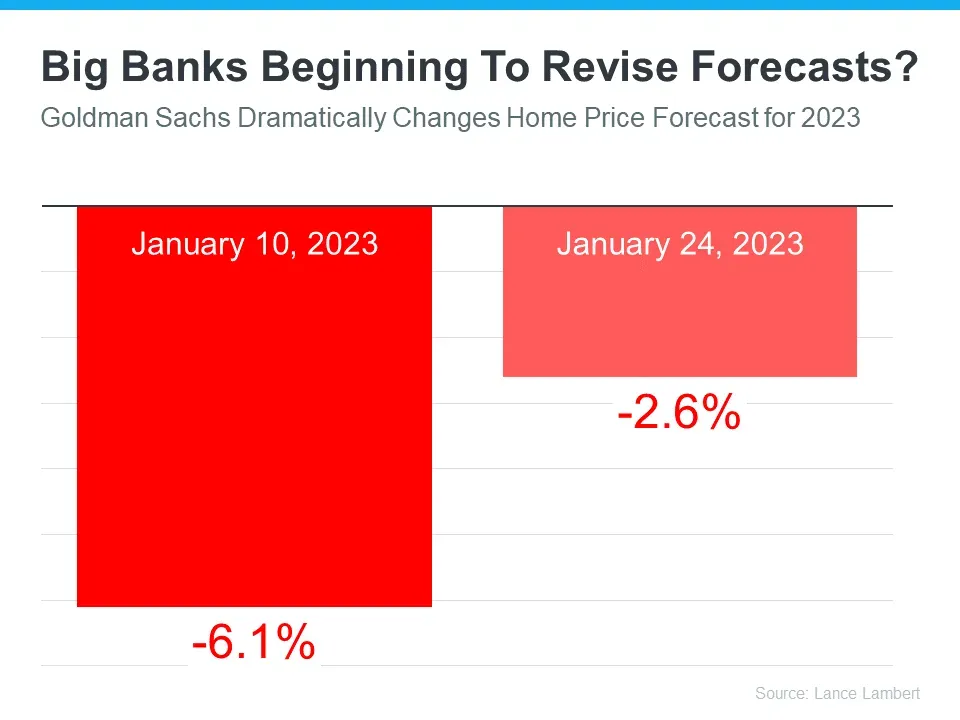

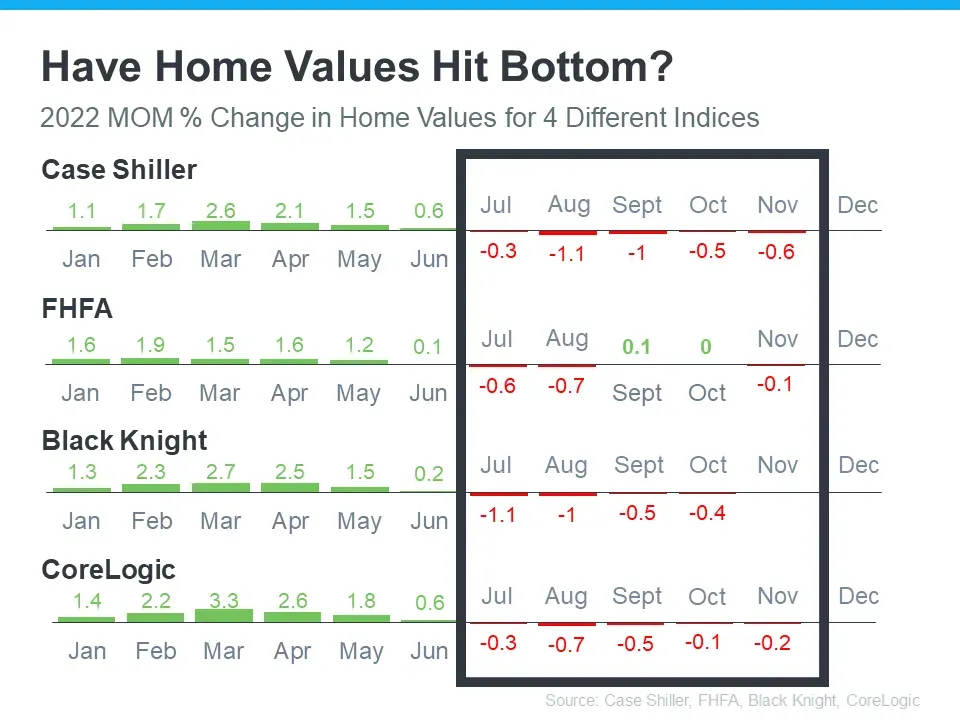

Here is some more exciting news about the real estate market. Big banks are starting to revise their previous forecasts. Goldman Sachs previously stated on January 16th that they believe real estate in this country is going to lose a little over 6% value. -6.1% depreciation to be exact. On January 24th they rapidly updated that figure to -2.6%. Big banks and forecasters started off by saying it’s going to be disastrous this coming year and now they are saying with their adjustments that maybe it’s not going to be that bad, maybe we were wrong about our earlier forecasts. What we know based on data is the peak in depreciation happened sometime between July 2022 and November 2022.

Headlines Do More to Terrify Than to Clarify

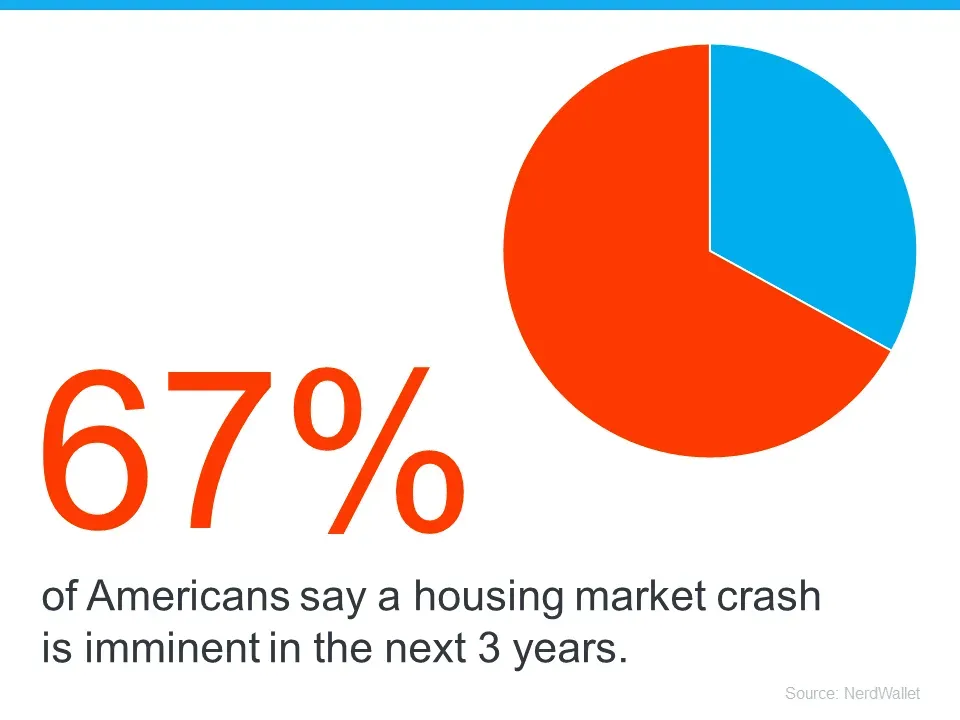

A lot of the news media headlines made people pause their home-buying journey. Based on news media headlines alone 67% of Americans say a housing market crash is imminent. That’s 2 out of 3 people. The reason people say this is due to so much confusion based on headlines. This is proof that even though the data say differently, the narrative of the media can sway consumers. This is due to a lot of confusing headlines like these:

Let’s take the recent foreclosure data and break it down.

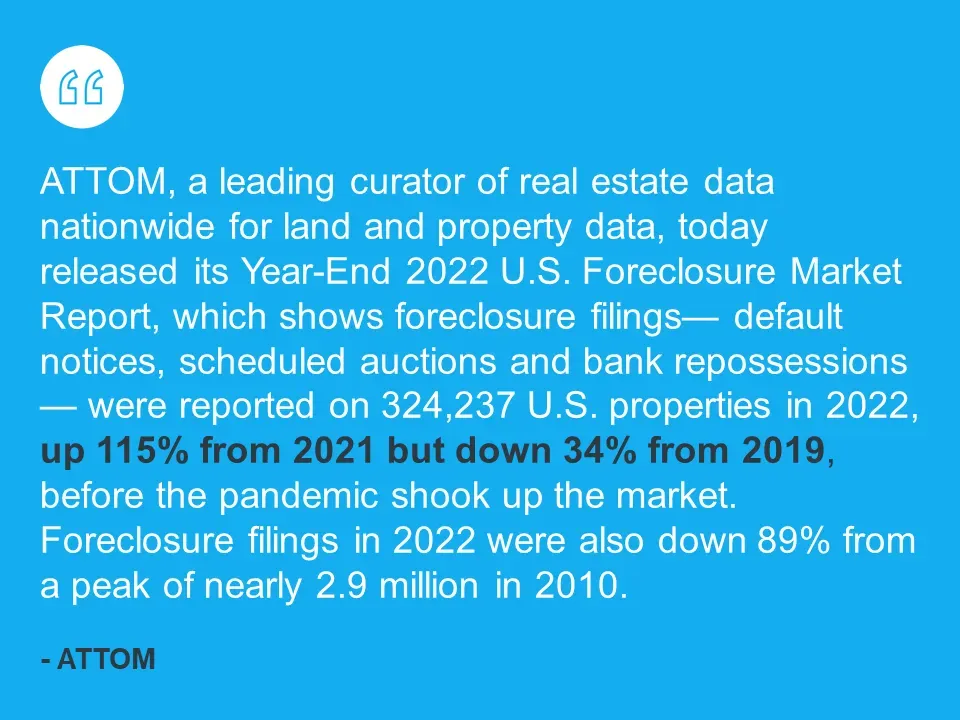

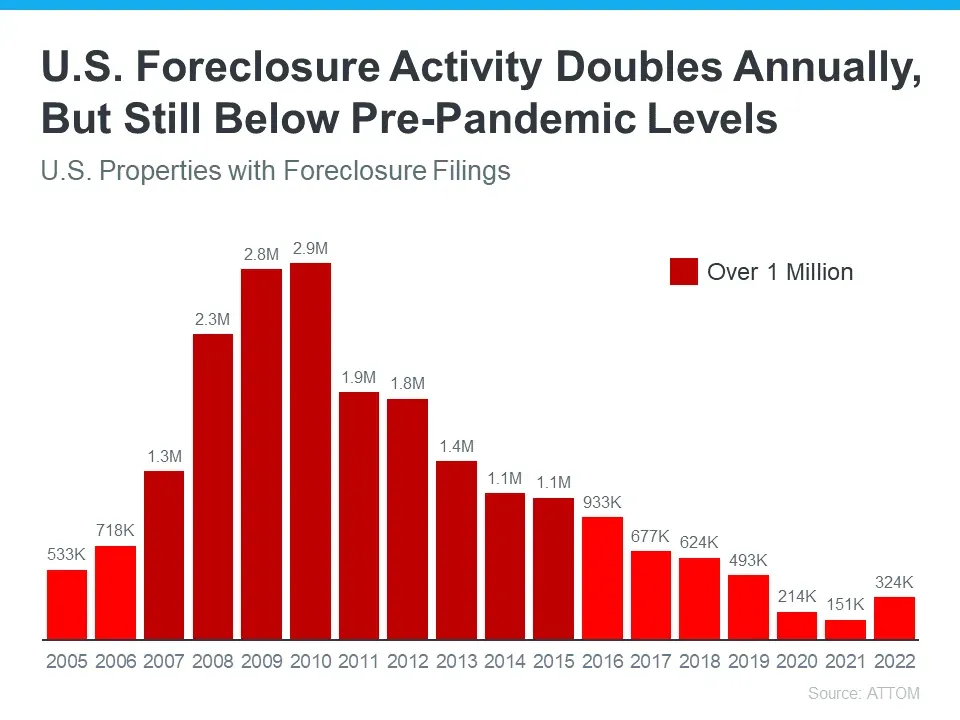

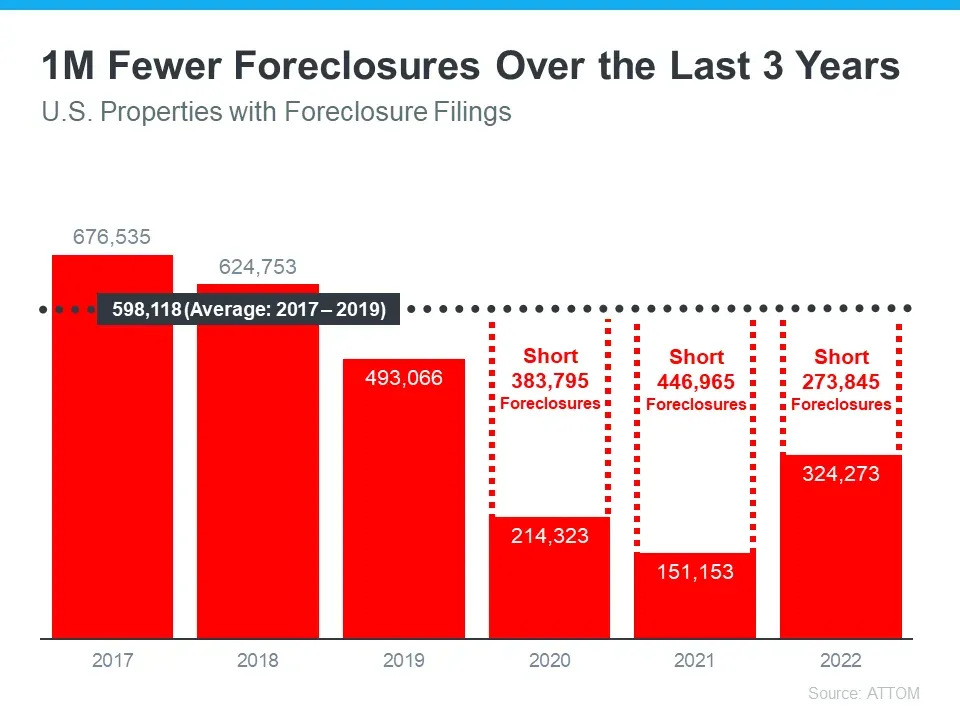

Even though the headlines of foreclosure up 115% are factually correct it gives a different narrative compared to the whole story. Foreclosure filings are down 34% from 2019 and down 89% from the peak of 2.9M in 2010. A lot of the media headlines go straight to the statistic that grabs the most attention. The headlines however don’t give the full story. Let’s look at the full story visually.

This bar graph shows U.S. Properties with foreclosure filings all the way back to 2005. In the dark red bars of 2007 to 2015 we had over 1 million foreclosure filings per year. Although foreclosures are up 115% from 2021 they are nowhere near what we had leading into the housing crash. We are in a completely different place and market right now. We have more regulations and loan qualification requirements than what caused the market to crash previously.

Looking even closer at the data, we have had 1M fewer foreclosures over the last three years compared to normal years. From 2017-2019 we averaged roughly 600K foreclosure filings. From 2020-2022 we had the forbearance program, higher equity available to sell and avoid foreclosure,s and more scenarios that allowed us to have record-low foreclosures over the last three years

With all the data we have shared it is important to stick to the facts. Media sells, fear sells, and negativity sells. Always keep in mind what the whole story is. All too often we make decisions on content without the full context. We would like to close this edition of The Smith Report by wishing you all continued success in all your endeavors this 2023!

Don’t be easily swayed or fooled by the headlines of the news. Fake news headlines are made to sell news by people who don’t understand or work in the Real Estate Market. Remember that those are news stories, fake news, and that negativity sells not the heroic events or our military, law enforcement, paramedics, firefighters, doctors, and nurses.

Seek the reality of the situation.

As always, we are not here to hustle you, we are not here to sell you… We are here to inform you, we are here to serve you, and we are here to help.

We are more than happy to provide you exclusive access to Off-Market Properties such as foreclosures, pre-foreclosures, for-sale-by-owners, and our exclusive RBID homes and other distressed sales that you won’t find on Zillow, Trulia, or Realtor.com.

We are more than happy to provide you with a free market evaluation to determine what your home would sell for. Also, we can give you tips on what to do and what not to do to sell your home for the most amount of money, and we can go over all of the various closing costs you will incur so you will know exactly what you’ll have left in your pocket after all expenses.

If you are looking to buy now, or sell now, we are always available to provide the most accurate market evaluation and create the most detailed step-by-step plan for your successful home-buying journey.

Feel free to call or text us at (714) 406-1414.